Similar Posts

Is the ATO Watching You For Expensive Assets?

Probably. The Australian Taxation Office (ATO) new programs are focusing on investment property and luxury items owners. So, if you own luxury items like boats or planes, they may look at your assets and your tax returns more closely. Here’s what you should know. Investment Properties (Report Everything) The ATO has started collecting detailed info…

5 Ways to Get Your Business to Run Without You

Some owners focus on growing their profits, while others are obsessed with sales goals. Have you ever considered making it your primary goal to set up your business so that it can thrive and grow without you? A business not dependent on its owner is the ultimate asset to own. It allows you complete control…

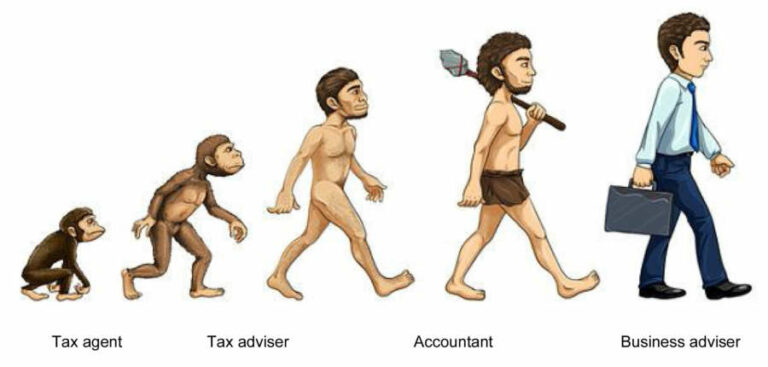

Changing accountants – Changing accountants is easy

A few years ago ANZ conducted a survey of SME accounting clients. An astonishing 43% of respondents said that they would change accountants if an appropriate one was presented. This is a measure of “perceived indifference” rather than hostile dissatisfaction. Compare that to the fact that accounting practice clients are generally perceived to be highly…

Can You Sell Your Home Tax Free? The truth about the “Main Residence Exemption

You may have heard that selling your family home is tax free. That the “Main Residence Exemption” can exempt your home from capital gains tax (CGT). Well, like all things tax related… … it depends on whether the property you’re selling meets the Australian Taxation Office’s (ATO) “Main Residence” criteria. What Makes a Home Your…

Online Services for Business

In an update to tax professionals on the 9 February 2021, the ATO is replacing the Business Portal with the new service ‘Online services for Business’. It has greater functionality than the Business Portal and has faster processing time. Please note that the ATO recommends that sole traders continue to use the ATO online services…

Can I claim my crypto investment losses?

The ATO has released updated information on claiming cryptocurrency losses and gains in your tax return. The first point to understand is that gains and losses from crypto are only reported in your tax return when you dispose of it, i.e. You sell it Convert it to a fiat currency Exchange it for another type…